As inflation hits record high, three-quarters of Canadians say now is not the time to make a major purchase

Lack of confidence in Bank of Canada outweighs faith in institution to correct course on inflation

July 28, 2022 – The summer of sticker shock continues as the Bank of Canada throws larger and larger interest rates in the way to slow down runaway inflation.

New data from the non-profit Angus Reid Institute finds Canadians’ keeping their wallets closed to major purchases as inflation gobbles up more of their budgets on essentials such as groceries and gas.

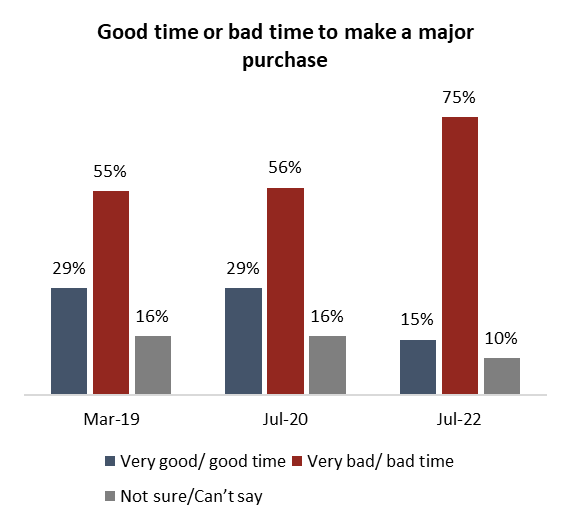

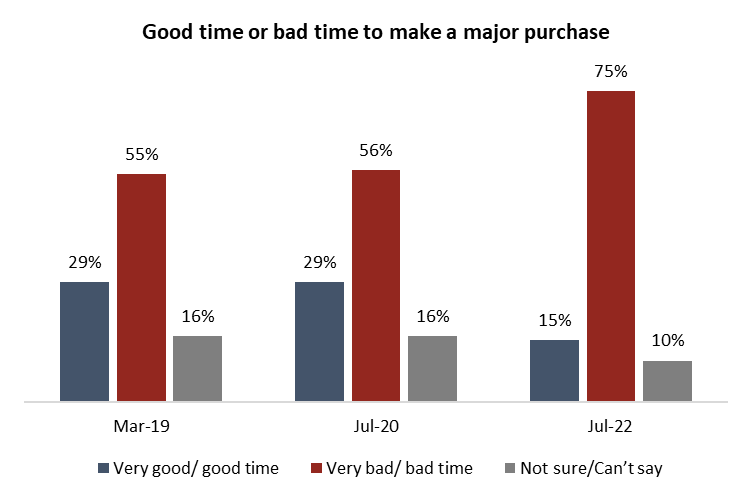

Fully three-quarters of Canadians say it’s a bad time to make a major purchase such as a home, car, renovation, or big vacation. This represents a significant increase from two years ago, when 56 per cent said the same. In that same time period, the number of Canadians who disagree and say it’s a good time to spend on big ticket items has halved.

This comes as a significant minority of Canadians say they are in dire financial straits. Approaching three-in-ten (28%) say they are either barely keeping their head above water or worse when it comes to their finances. That figure has climbed 10 points since July 2020.

As inflation reaches highs not seen in decades – June’s figure of 8.1 per cent was the highest since January 1983 – all eyes are on the Bank of Canada as it attempts to correct course. Most Canadians 71%) say they are following the BoC’s actions closely. However, many don’t like what they’ve seen. More than half (53%) of Canadians say they don’t have confidence the Bank is making the right decisions in its fight against inflation. One-third (33%) have more faith.

Despite the apolitical nature of the institution, the BoC has become a political story in recent months as governor Tiff Macklem was singled out by Conservative MP Pierre Poilievre during his leadership campaign. Indeed, past CPC voters show less faith (26% confident) than other partisans in the Bank’s ability to steer the nation out of this crisis. Lack of confidence (47%) is more common than not (34%) among those who voted NDP in last fall’s election as well. Belief in the Bank is higher among past Liberal (47%) and Bloc Québécois (53%) voters.

More Key Findings:

- While faith in the Bank of Canada is higher among past Liberal and Bloc voters, still at least two-in-five among those voting groups are not confident in the BoC’s strategy to fight inflation.

- Those in B.C. are most likely to say now is a good time to make a major purchase at 18 per cent. Notably, however, two-thirds (67%) in that province disagree.

- Two-in-five in Manitoba (40%) say they are in bad or terrible shape financially, the largest proportion in the country to say this.

About ARI

The Angus Reid Institute (ARI) was founded in October 2014 by pollster and sociologist, Dr. Angus Reid. ARI is a national, not-for-profit, non-partisan public opinion research foundation established to advance education by commissioning, conducting and disseminating to the public accessible and impartial statistical data, research and policy analysis on economics, political science, philanthropy, public administration, domestic and international affairs and other socio-economic issues of importance to Canada and its world.

INDEX

Part One: The financial picture

-

Three-in-ten say they’re in bad shape financially

-

Consumer confidence is low

Part Two: All eyes on the BoC

-

Most Canadians following as BoC raises rates

-

Half don’t have faith in BoC to correct course

Part One: The financial picture

Three-in-ten say they’re in bad shape financially

The story of the summer is inflation. Statistics Canada announced the Consumer Price Index rose 8.1 per cent year over year in June, the largest annual increase since January 1983. One of the major sources of this inflation is gasoline, but even when that is removed from the CPI, inflation is recorded at 6.5 per cent in June. According to the Bank of Canada, there is no relief in sight. The latest forecast from the BoC pegs inflation to average 7.2 per cent throughout 2022, an increase from the 5.3 per cent it forecast in April. Inflation isn’t expected to return to two per cent – the target set out by the BoC – until the end of 2024.

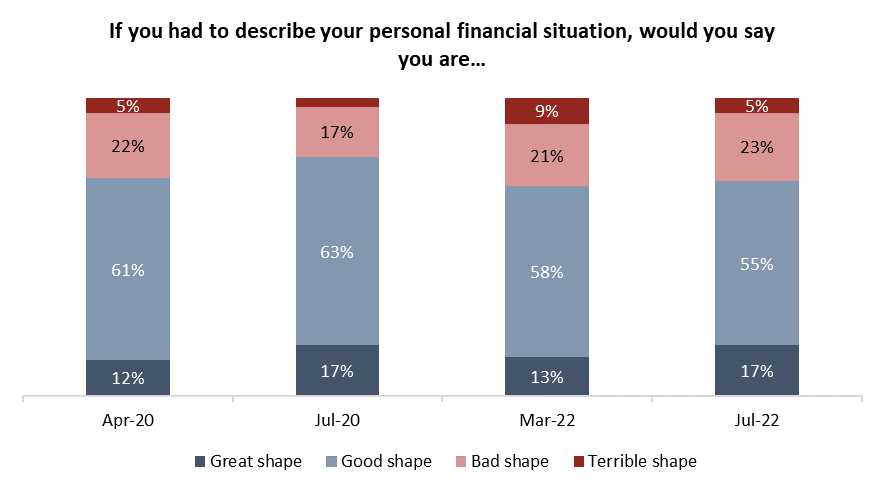

As nearly everything becomes more expensive, three-in-ten (28%) Canadians would describe their financial situation as bad or terrible. That measure has remained consistent this year but has increased 10 points from two years ago, when one-in-five said the same.

Currently, fewer than one-in-five (17%) say they are in great shape with no concern of the future. More than half (55%) would describe their personal financial situation as good, but with some worries about the long term:

Younger Canadians are much more likely to say they are in bad financial shape. At least three-in-ten of all demographics under the age of 54 say they are in bad or terrible financial shape, including two-in-five (41%) among women aged 35- to 54-years-old. Comparatively, one-in-five of men (18%) and women (20%) over the age of 54 say the same. In fact, one-quarter (24%) of men that age say their finances are great with no concerns for the future, the most of any demographic:

Financial anxiety is not evenly distributed across the country. Two-in-five (40%) in Manitoba say they are in poor financial health, the most in the country. They are joined by more than one-third in Saskatchewan (36%) and Atlantic Canada (36%). Meanwhile, more than three-quarters (77%) in Quebec say they are in good or great shape financially, the most in the country:

Consumer confidence is low

As inflation boosts the price of essentials, there is much less appetite for major purchases like buying a home or car, renovations, or big vacations. Fully three-quarters (75%) say now is a bad time to make a major financial outlay, a significant increase from the more than half (56%) who said the same two years ago. Fewer than one-in-six (15%) say instead it’s a good or very good time to buy a home or car, half the number who said so in March 2019 and July 2020:

Consumer optimism is higher among those in higher income households but tops out at one-in-five saying it’s a good time to make a major purchase. In households earning less than $50,000 annually, four-in-five disagree:

*Smaller sample size, interpret with caution

Majorities in every region in the country say it’s a bad time to make major purchases, ranging from two-thirds (67%) in B.C. to more than four-in-five (83%) in Saskatchewan. While pessimism rules, optimism is highest in B.C. and Ontario, where approaching one-in-five believe it’s the right time to go on a major vacation or embark on significant home renovations:

Part Two: All eyes on the BoC

Most Canadians following as BoC raises rates

Many of the stressors agitating inflation are global in nature – for example, supply chain woes increasing the cost of shipping and Russia’s invasion of Ukraine severing energy ties and driving up the cost of food. Still, at home, the Bank of Canada controls a major policy lever – interest rates – to affect inflation. So far this year, the Bank has raised its key interest rate from a historic low of 0.25 per cent to 2.5 per cent.

Most Canadians (71%) say they are following news around the BoC’s attempt to put the brakes on runaway inflation closely or very closely. One-quarter (24%) are keeping less of an eye on it, while few (5%) say they aren’t following the issue at all.

To contextualize this high rate of engagement on the issue, by comparison, rising rates is drawing much more interest than the conflict in the Ukraine – 56 per cent say they are following that story closely.

Related: Turbine Troubles: Should Ottawa have sent pipeline parts back to Russia? Canadians weigh in

Half don’t have faith in BoC to correct course

After raising rates by a one full percentage point, the highest such raise since 1998, BoC governor Tiff Macklem said the bank’s “credibility is being tested” by this inflation crisis. Indeed, Macklem himself has become a target of shells lobbed by MP Pierre Poilievre’s Conservative leadership campaign. In response, bank officials have admitted some fault in their strategy, saying the BoC should be “accountable” for failing to keep inflation in check. Macklem said that the Bank would have started raising rates earlier “if we had known everything a year ago that we know today.”

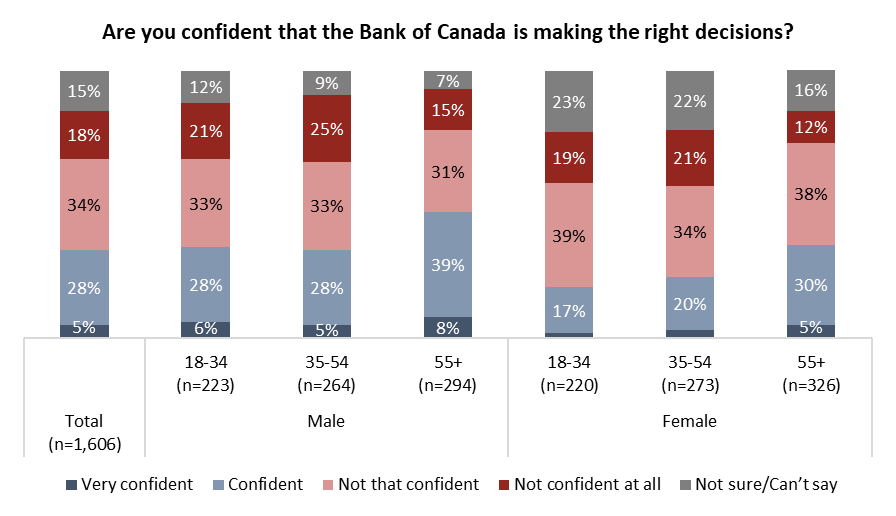

On the balance, Canadians are not confident the BoC is making the right decisions. Half say they are either not that confident (34%) or not confident at all (18%) in the BoC’s efforts to reduce inflation. One-third (33%) have more faith in the central bank.

Confidence is highest among men over the age of 54, the only demographic for whom there are nearly as many confident (48%) as not (45%):

Higher income households are more likely to express confidence in the BoC’s tact to reduce inflation. For most income brackets, however, a lack of confidence is the more likely opinion:

*Smaller sample size, interpret with caution

Poilievre’s threat to fire Macklem if he became prime minister was well received by approaching half (45%) of past CPC voters.

Indeed, two-thirds (67%) of those who voted Conservative in the fall say they aren’t confident that Macklem and the BoC are making the right decisions, more than double those (26%) who disagree. Confidence is outweighed by a lack of it among past NDP voters, as well. There is more faith in the BoC among those who voted Bloc (53%) and Liberal (47%) last fall:

Survey Methodology:

The Angus Reid Institute conducted an online survey from July 18-20, 2022 among a representative randomized sample of 1,606 Canadian adults who are members of Angus Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 2 percentage points, 19 times out of 20. Discrepancies in or between totals are due to rounding. The survey was self-commissioned and paid for by ARI.

For detailed results by age, gender, region, education, and other demographics, click here.

To read the full report, including detailed tables and methodology, click here.

To read the questionnaire in English and French, click here.

Image – Erik Mclean/Unsplash

MEDIA CONTACT:

Shachi Kurl, President: 604.908.1693 shachi.kurl@angusreid.org @shachikurl

Dave Korzinski, Research Director: 250.899.0821 dave.korzinski@angusreid.org