To Have & Have Not: Canadians take sides on housing market, divided in desire for home prices to rise, or tank

by David Korzinski | April 6, 2021 7:32 pm

High housing prices spreading outside urban hot zones, hurting Canadians from coast to coast

April 7, 2021 – Home sweet home. Home, where the heart is. Work from home. Homeschooling. If the places where Canadians rest their heads at night weren’t already an outsized part of the national conversation, more than a year of pandemic life has intensified the talk.

Not long after COVID-19 lockdowns began in May 2020, the head of the Canada Mortgage and Housing Corporation predicted a worst-case scenario[1] wherein housing prices would plummet as much as 18 per cent.

Instead, the opposite occurred. Average home prices in the country rose 25 per cent between this and last February.

Now, with the housing market “on steroids[2]” across the country, Canadians are taking sides. A new study from the non-profit Angus Reid Institute finds 40 per cent of Canadians hopeful that housing prices continue to escalate, while 39 per cent are banking on a fall. One-in-five (22%) would like to see the average home price drop by an astounding 30 per cent or more.

Notwithstanding the staggering knock-on effects of a housing crash of such magnitude on almost every other aspect of the Canadian economy, it is an undeniable indicator of the amount of housing pain people in this country are experiencing coast to coast, in large communities and small.

Three-in-five (57%) rural dwellers say housing prices in their community are too high, alongside two-thirds (67%) of those who live in small cities. These levels rise above seven-in-ten among urban and suburban Canadians.

Given these sentiments, the Angus Reid Institute researchers collated data into a Housing Pain Index to understand the experiences and trials of Canadians who are either priced out or trying to maintain the value of their investments.

This study takes an in depth look at Canadians in four groups: The Happy, Comfortable, Uncomfortable, and Miserable. While those who are suffering the most housing pain tend to be younger and lower-income, each of these four groups is well represented in all regions of the country.

More Key Findings:

- Those who live in Metro Vancouver, the GTA, Montreal, and Halifax are most likely to say housing prices in their city are unreasonably high; at least 56 per cent in each region say this

- Among those who do not currently own a home, only one-in-five (21%) do not want one. 45 per cent say they would like to but can’t afford it right now, while one-quarter (25%) say they would like to but doubt they’ll ever afford it

- Canadians are overwhelmingly critical of their provincial government’s handling of housing affordability. At least half of residents in every province canvassed say their government has done a poor job on this file

About ARI

The Angus Reid Institute (ARI) was founded in October 2014 by pollster and sociologist, Dr. Angus Reid. ARI is a national, not-for-profit, non-partisan public opinion research foundation established to advance education by commissioning, conducting, and disseminating to the public accessible and impartial statistical data, research and policy analysis on economics, political science, philanthropy, public administration, domestic and international affairs, and other socio-economic issues of importance to Canada and its world.

INDEX:

Part One: The Housing Pain Index

-

Where do they live?

-

Household income and the pain continuum

-

Recent owners have more stress

Part Two: How Canadians feel about the housing market

-

Critical of provincial governments from coast to coast

-

Half say housing prices in their city are ‘unreasonably high’

Part Three: Canadians divided on whether home prices should rise or fall

-

Homeowners want to protect their asset

-

Nearly half of B.C., Ontario residents want market to tank

Part Four: Views among homeowners

Part Five: The renter perspective

Part One: The Housing Pain Index

Last May, crown corporation Canada Mortgage and Housing Corporation (CMHC) predicted a potential 18 per cent drop[3] in home prices from pre-pandemic levels due to the COVID-19 pandemic. Contrary to this forecast, housing prices have continued to rise and break records, driven by[4] the relative endurance of higher-income households through the pandemic, low-mortgage rates, and copious spending by federal and provincial governments.

In fact, the actual national average home price reached a record $678,091 in February[5], a year-over-year increase of 25 per cent, and prices are expected to rise[6] more than 16 per cent again this year. This has prompted economists working at the Bank of Montreal to sound alarms about severe consequences[7] that may result from unmitigated growth in prices.

Typically hot real estate markets such as the GTA[8] and Metro Vancouver[9] have seen record-setting activity and prices, but less historically pricey markets such as Halifax[10] and smaller towns including Woodstock, ON have also seen historic spikes.

The result has been increases in housing stress across the country. To understand the impact of Canada’s boiling housing markets on the people who live in those homes, the Angus Reid Institute asked Canadians a series of questions: about their own experience, about the impact of cost of living on their own lives, about what they expect to happen in the future, and about what they wish would happen in the future. Note that homeowners are those who own any type of property, whether it is a condo, apartment, detached home or otherwise.

Based on these questions, and whether they currently rent or own their home, ARI researchers constructed a Housing Pain Index. Canadians were sorted into four groups based on their relative comfort and expectation when it comes to housing.

The Happy (13% of the population) are those who have little stress when it comes to housing:

- They’re older and higher-income

- Most likely to own a home and to have purchased that home more than 15 years ago

- Most (73%) do not currently pay a mortgage

- Among those who do pay a mortgage, all but a few could handle a monthly increase of $500 or more with relative ease

The Comfortable (26% of the population):

- Also older and higher income, less stressed than most Canadians when it comes to their housing situations

- Seven-in-ten are homeowners

- Two-in-five pay a mortgage (38%) while the rest have paid one off (62%)

- Among renters in this group, four-in-five say the amount they pay is either reasonable or maybe a bit low.

The Uncomfortable (36% of the population):

- Equally likely to be found in every province (between 32% and 39% in every region)

- They’re almost identically distributed between three household income levels (less than $50K, $50-99K, and more than $100K) and three age groups (18-34, 35-54, and 55+)

- More than half of the Uncomfortable (60%) own homes, three-in-ten (31%) rent

- Four-in-five (82%) homeowners in this group have a mortgage, just half (50%) of whom say they can manage the payments ‘quite easily’

The Miserable (24% of the population):

- Are the youngest group, demographically

- Are most likely to be in lower household income brackets,

- The most likely to be renters (42%)

- Among those who do own a home, 97 per cent have a mortgage; only 10 per cent of them can manage payments with ease

- Four-in-five who are not home owners in this group say they would like to buy but can’t afford it

Where do they live?

The percentage of Canadians who are Happy when it comes to their housing situation is relatively consistent across the country. No fewer than 11 per cent and no more than 16 per cent fall into this group in each region of the country. Meanwhile, the Miserable are most commonly found in Alberta, as financial pressure has put Albertans in a situation where many find their rent and mortgage payments more challenging to meet. That said, these data speak to an emerging trend which appears to split Canadians largely into two camps on the top and bottom of this Index. At least 55 per cent of residents in every province canvassed are either Uncomfortable or Miserable:

*Because its small population precludes drawing discrete samples over multiple waves, data on Prince Edward Island are not released.

Across major metropolitan areas of the country, Halifax and Calgary residents are most likely to be facing severe housing and financial stress, which places them in the Uncomfortable or Miserable categories. Conventional wisdom and a well-documented struggle with housing prices has suggested that residents of Metro Vancouver or the Greater Toronto Area were most prone to these stresses, but the housing crunch is now spread across the country. In Halifax, bidding wars have become common over the past year, leading the Canada Mortgage and Housing Corporation to raise its assessment[11] of the housing market in that city from low to moderate, which suggests that housing has become overvalued compared to what residents can generally afford:

Perhaps the most staggering of these data involves the infiltration of housing pain to non-urban parts of the country. Those dealing with prohibitive housing prices or difficulty paying mortgages are found in all corners of the nation, with at least one-in-five in rural areas (22%) falling into the Miserable category.

Household income and the pain continuum

As one might expect, household income plays a significant role in where a person sits within the Housing Pain Index. That said, a significant number of Canadians across all income levels are found in each category. In 2018 the Angus Reid Institute noted a similar trend[12], as the increased cost of living has created considerable challenges for Canadians of all income levels:

Age is a more predictive indicator of a person’s placement in the Housing Pain Index than any other demographic. The Miserable are far more likely to be younger, while a considerable proportion of the Happy and Comfortable are older than 64 years of age:

Those on the Index who are among the Happy or Comfortable are much more likely to own their current residence, at least 66 per cent do. The Miserable, meanwhile, are close to evenly split between renting and owning.

Recent owners have more stress

Another key element of this discussion is the timeframe in which their home was purchased. Those who are Happy and Comfortable are more likely to have entered the market more than 15 years ago:

Having purchased longer ago, the Happy and the Comfortable are far more likely to have paid off their mortgage. This is a key element of housing pain: despite historically low mortgage rates[13] offered in the last year, the yoke of paying off a place that is historically far more expensive means those with a mortgage are far more likely to be Uncomfortable or Miserable.

Part Two: How Canadians feel about the housing market

Critical of provincial governments from coast to coast

Taking stock of the housing market yields massive frustration. When asked how their provincial government is performing on the issue of housing affordability, at least 52 per cent of residents in every province canvassed say they’ve done a poor job. This, as average housing provinces have shot up from coast to coast. And while governments at all levels have, depending on the jurisdiction implemented policies aimed at blunting the worst of the pain (speculation taxes, blind bidding processes, more supply), it is, the minds of Canadians, hardly “job well done”:

Half say housing prices in their city are ‘unreasonably high’

Half of Canadians say that the price of a home in their city is unreasonably high, while another quarter (24%) say that the price is high, but understandable given the area. Just one-in-five Canadians say that the price of a home in their city (19%) or neighbourhood (22%) is reasonable:

In urban centres across the country the frustration is palpable. Residents in Metro Vancouver, the GTA, Montreal and Halifax all overwhelmingly say that home prices in their city are unreasonably high. Those in Edmonton, Calgary, and Winnipeg are most likely to classify homes in their cities as “reasonable”:

The change in opinion in some urban centres over the past five years is staggering. In 2016, when the Angus Reid Institute asked the same question, half as many Montreal residents felt that home prices were unreasonably high. There have also been notable increases in the GTA, while Vancouverites sustain an ongoing level of outrage:

*Respondents asked about the “typical price of a home in your community” in 2016

The feeling that housing prices are too high is pervasive regardless of community size. Whether they live in a rural area, small town, urban city, or suburb, at least 41 per cent of Canadians in each say this:

Across the Housing Pain Index, frustration with the market price of housing rises with pain. Three-in-five (63%) among the Miserable say that prices are unreasonably high where they live. This drops to a still significant 31 per cent among the Happy. Nonetheless, even among those in the most comfortable positions, few feel that housing prices are currently at reasonable levels:

Part Three: Canadians divided on whether home prices should rise or fall

While few in Canada feel that the current price demanded for a home is reasonable, there are a significant number of Canadians that would like to see them either sustain or rise.

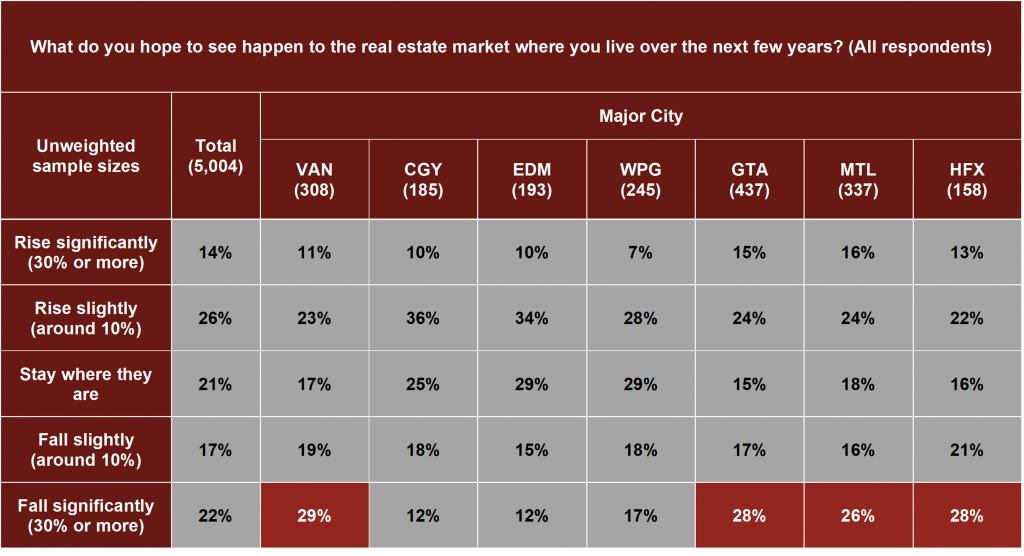

Overall, two-in-five would like to see home prices increase. On the other end of the spectrum, the same number (39%) would like to see home prices fall into more affordable ranges. One-in-five (22%) are hoping for what would be a catastrophic drop in prices.

Canada’s housing bubble puts much of the country in a precarious situation. If, indeed, housing prices did fall considerably, it would portend enormous challenges; Canada is currently more dependent[14] on residential investment than it ever has been before:

Homeowners want to protect their asset

There are widely divergent perspectives on this question based on whether a person owns a home or not. As one might anticipate, homeowners are largely in the camp of hoping that their investment maintains or increases its value. That said, one-in-five owners (22%) say that they hope prices fall, despite what could be a significant hit to the values of their own properties. For those who rent, two-thirds would like prices to fall, with a significant proportion hoping for a massive market depression:

Nearly half of B.C., Ontario residents want market to tank

Regionally, it is those dealing with the highest home prices in the country that are most likely to want a massive reduction in prices. Three-in-ten in B.C. (28%) and Ontario (28%) hold this view. Meanwhile, Albertans are most likely to want housing prices to increase (49%):

At the urban level, Montrealers are much more likely than others in Quebec to hope for a massive drop in housing prices. They, alongside people in Halifax, the GTA, and Metro Vancouver, are the most likely in the country to want to see real estate prices crash:

Perspectives are varied within the four groups on the Housing Pain Index. Those who are Happy or Comfortable lean toward having prices continue to rise. The Uncomfortable are notably divided, while the Miserable are most likely to hope for a considerable drop:

Part Four: Views among homeowners

Homeowners in Canada have their own perspective on housing issues. It is worth immediately noting that Canadians over the age of 35 are far more likely to be in this class of living arrangement:

When they consider their own home, owners are aware of the potential overvaluation of this asset. One-in-five (22%) say that their own home is unreasonably expensive in the current market while one-in-three say the price is maybe higher than it should be, but understandable given where they live. Only one-in-ten (10%) say their home value is lower than it should be:

Two-thirds (64%) of homeowners are currently paying a mortgage (see detailed tables[15]). Among this group, half (47%) are able to manage payments quite easily, while 40 per cent are managing but being careful, and 12 per cent are having more difficulty.

Difficulty with mortgage payments is something with which Canadians of all ages struggle. Notably, those Canadians over 64 years of age, many of whom are retired and have a fixed monthly income, are least likely to be able to afford any change in their current payment level:

Those who managed to enter the market with lower household income levels are particularly stretched. Half (47%) with household income levels under $50 thousand say that they have no wiggle room at all:

Part Five: The renter perspective

Renters are largely split between they view that the rent they pay is “reasonable overall” (46%) and “high” (44%). Half of this latter group say they are paying an unreasonably high amount:

Regional differences factor into the picture. Those who rent in Saskatchewan and Quebec are most likely to say that what they pay is reasonable, while those in B.C. and Manitoba are most likely to say either that their rent is unreasonable, or high but justified given where they live. In each province, this latter perspective represents the majority view:

Looking at the three largest urban areas, more than half of renters in Metro Vancouver say they are paying high rent, compared to about the same number of renters in Montreal (52%) who say it’s reasonable – nearly double the proportion on the west coast. Toronto renters are somewhere in between, their sentiments more closely resembling the national average.

The Housing Pain Index illustrates further how experiences of renting vary sharply. Among the Happy and Comfortable segments of Index, few see their rent costs as an unreasonable burden. Conversely, those in the Miserable category are more likely to view their rent as either unjustifiably high (37%), or understandable, but no less painful (31%). With the average Canadian renter spending nearly a quarter of their entire income[16] on rent, these differences clearly represent major impacts on the finances and daily lives of renters.

For those who dream of getting out of a rental situation into one in which they own, many see the rapidly rising costs[17] of actually owning a home as even more shocking.

Among those who do not own their home, 70 per cent say they simply can’t afford to buy one, either because they don’t have the money (45%) or are fairly sure they never will (25%). There is also a significant cohort of renters simply self-selecting out of ownership. For the one-in-three who cite something other than affordability for why they don’t own a home, the majority say they’re not interested in buying one.

Those who are under 55 are far more likely to say they do not have enough money as of now, while those who are older have the highest share saying they are simply not interested.

Many have ruled out the idea that they will ever be able to afford home ownership, including one-in-five 18- to 34-year-olds. This proportion rises to one-in-three among those ages 35 to 44, despite still having decades before they hit retirement age.

Though non-home-owners with higher incomes are of course far less likely to say they will never be able to buy, more than half (54%) say they can’t afford to at the moment.

Notes on methodology

The Housing Pain Index

The Angus Reid Institute’s Housing Pain Index scores respondents according to their answers to a series of questions on their current personal finances and housing situation. Scores for each answer are aggregated to produce a total score for each respondent. A higher score indicates a more precarious housing situation, and a lower score indicates a more secure situation.

The Index is based on eight questions in total, though respondents would only answer between five and six of them, depending on whether they own property and whether that property has a mortgage or not.

Scores ranged from -3 to 17, with a larger concentration of respondents near the middle of the scale. Those with scores from -3 to 1 were sorted into the Happy category, those with scores from 2 to 4 became the Comfortable category, those with scores from 5 to 8 became the Uncomfortable, and those with scores of 9 or higher were sorted into the Miserable category.

Sampling Methodology

The Angus Reid Institute conducted an online survey from February 26 – March 3, 2021 among a representative randomized sample of 5,004 Canadian adults who are members of Angus[18] Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 1.4 percentage points, 19 times out of 20. Discrepancies in or between totals are due to rounding. The survey was self-commissioned and paid for by ARI.

For detailed results by age, gender, region, education, and other demographics, click here.[19]

For detailed results by major city, city size, and home ownership, click here.[20]

For detailed results by the Housing Pain Index, click here.[21]

To read the full report, including detailed tables and methodology, click here.[22]

To read the questionnaire, click here.[23]

Image – Robert Linder/Unsplash

MEDIA CONTACTS:

Shachi Kurl, President: 604.908.1693 shachi.kurl@angusreid.org[24] @shachikurl

Dave Korzinski, Research Director: 250.899.0821 dave.korzinski@angusreid.org[25]

- worst-case scenario: https://www.theglobeandmail.com/business/article-cmhc-boss-evan-siddall-acknowledges-errors-on-last-years-prediction-of/

- on steroids: https://globalnews.ca/news/7682155/canada-home-prices-coronavirus/

- potential 18 per cent drop: https://www.bnnbloomberg.ca/cmhc-never-pretended-to-have-an-crystal-ball-on-home-prices-ceo-1.1570358

- driven by: https://financialpost.com/real-estate/canada-house-prices-to-build-up-this-year-outpace-inflation

- February: https://www.cbc.ca/news/business/crea-expects-record-home-sales-1.5949859

- expected to rise: https://www.cbc.ca/news/business/crea-expects-record-home-sales-1.5949859

- severe consequences: https://www.theglobeandmail.com/business/article-bmo-report-calls-on-policymakers-to-douse-the-fire-on-rapidly-rising/

- GTA: https://blog.remax.ca/greater-toronto-real-estate-prices-shatter-records-in-these-areas/

- Metro Vancouver: https://globalnews.ca/news/7736012/march-vancouver-home-sales-records/

- Halifax: https://atlantic.ctvnews.ca/covid-19-has-been-a-boon-to-halifax-real-estate-market-1.5348380

- raise its assessment: https://www.cbc.ca/news/canada/nova-scotia/halifax-s-rising-house-prices-present-increasing-risk-cmhc-1.5847724

- similar trend: https://angusreid.org/poverty-in-canada/

- historically low mortgage rates: https://financialpost.com/real-estate/mortgages/canadian-mortgage-rates-are-the-lowest-in-history-can-they-go-any-lower

- more dependent: https://betterdwelling.com/canadas-over-30-more-dependent-on-real-estate-than-the-us-in-2006-shows-gdp/

- see detailed tables: https://angusreid.org/wp-content/uploads/2021/04/2021.04.07_Housing_PRTables_Demos.pdf

- quarter of their entire income: http://rentalhousingindex.ca/en/#comp_prov

- rapidly rising costs: https://www.theglobeandmail.com/business/article-bmo-report-calls-on-policymakers-to-douse-the-fire-on-rapidly-rising/

- Angus: http://www.angusreidforum.com

- click here.: https://angusreid.org/wp-content/uploads/2021/04/2021.04.07_Housing_PRTables_Demos.pdf

- click here.: https://angusreid.org/wp-content/uploads/2021/04/2021.04.07_Housing_PRTables_Ctabs.pdf

- click here.: https://angusreid.org/wp-content/uploads/2021/04/2021.04.07_Housing_PRTables_Index.pdf

- click here.: https://angusreid.org/wp-content/uploads/2021/04/2021.04.07_Housing.pdf

- click here.: https://angusreid.org/wp-content/uploads/2021/04/2021.04.07_Housing_Qnaire.pdf

- shachi.kurl@angusreid.org: mailto:shachi.kurl@angusreid.org

- dave.korzinski@angusreid.org: mailto:dave.korzinski@angusreid.org

Source URL: https://angusreid.org/housing-prices-2021/