Inflation Anxiety: More Canadians say they’re worse off now financially than any time since 2010

Financial worry hammers low-income households as pandemic enters third year

January 21, 2022 – A new study from the non-profit Angus Reid Institute finds some Canadians struggling more than ever to endure the financial stresses of the pandemic, while others, secured by their relatively strong position of wealth, have seen their economic well-being maintained, if not improved.

Indeed, on the negative end of this spectrum, two-in-five (39%) Canadians say they are worse off now than they were last year. This represents the largest group saying this in 13 years of tracking by ARI. This segment of the population is comprised largely of those who have lower incomes, more precarious housing situations, and difficulty keeping up with inflationary trends while relying on stagnant wages.

On the other end of the spectrum are higher-income, low-debt households, who have seen their position either unchanged over the past year or improved.

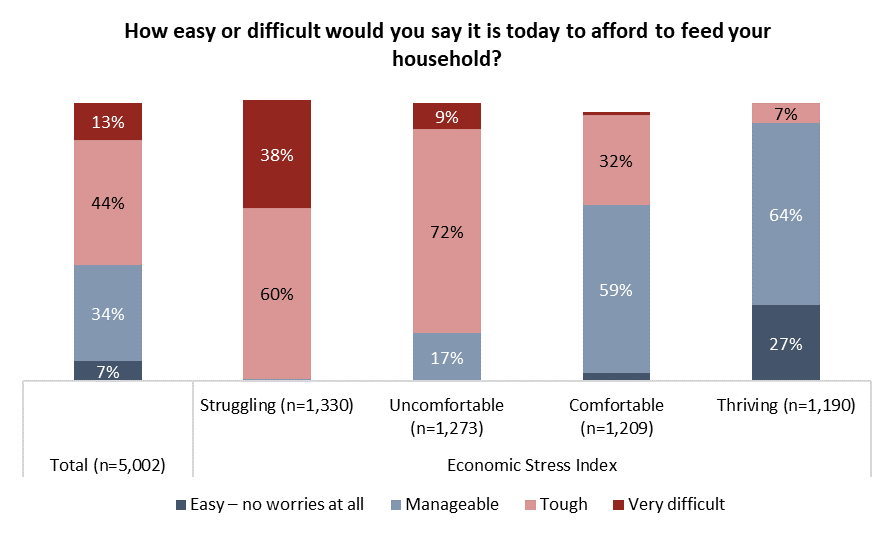

Notably, amid the highest level of inflation seen in 30 years, approaching three-in-five (57%) Canadians say that it is currently difficult to feed their household. In 2019, when the Angus Reid Institute asked this same question, 36 per cent said this aspect of their finances was causing them difficulty.

As Canadians endure these challenges, many expect worse to come. One-quarter (23%) of Canadians are optimistic that their financial standing will improve in the next 12 months, but more – 29 per cent – say it will worsen.

More Key Findings:

- Residents in Alberta (49%), Saskatchewan (47%), and Newfoundland and Labrador (47%), are most likely to say they are worse off now than they were last year. At least one-in-three in every region say this, though that group is smallest in Quebec (33%).

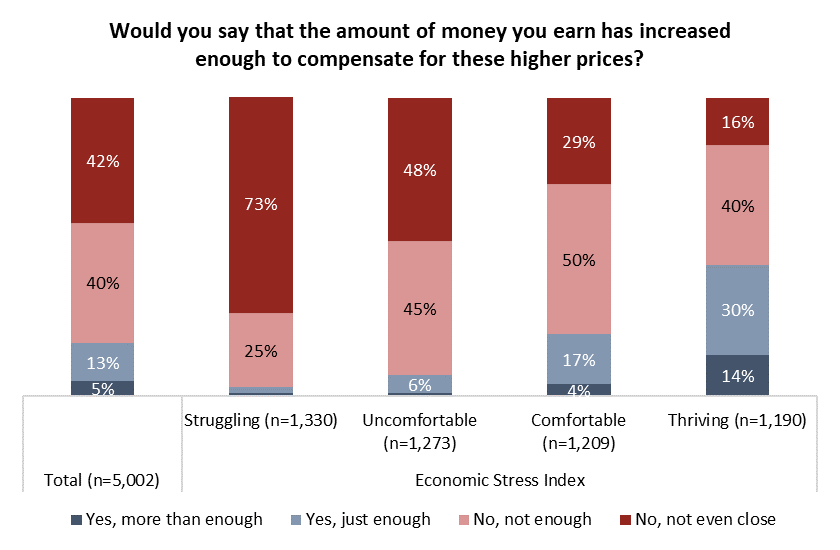

- Four-in-five Canadians (82%) say that the increase in cost of living has outpaced any income growth they have seen in their household.

- Debt remains a major source of stress for one-quarter (24%) of Canadians and a minor concern for two-in-five (42%).

- With many economists expecting a rate hike from the Bank of Canada sooner rather than later, one-quarter (25%) of Canadians believe an increase in interest rates would have a major negative impact on their household finances.

About ARI

The Angus Reid Institute (ARI) was founded in October 2014 by pollster and sociologist, Dr. Angus Reid. ARI is a national, not-for-profit, non-partisan public opinion research foundation established to advance education by commissioning, conducting and disseminating to the public accessible and impartial statistical data, research and policy analysis on economics, political science, philanthropy, public administration, domestic and international affairs and other socio-economic issues of importance to Canada and its world.

Note: Because its small population precludes drawing discrete samples over multiple waves, data on Prince Edward Island is not released.

INDEX:

Part One: Economic pessimism outweighs optimism

-

Two-in-five say they’re worse off than they were 12 months ago

-

And what about the year ahead?

Part Two: Economic Stress Index

-

Regional story

-

Major urban centres

-

“Middle age” = elevated stress

-

Low income households face huge challenges

-

The Struggling see little hope ahead

Part Three: Personal economic challenges

-

Debt a major source of stress for one-quarter of Canadians

-

Majority believe looming rate hike would have negative personal impact

-

For now, majority find their housing costs manageable

-

Number struggling to feed their household increases significantly

-

Wages not keeping pace

Part One: Economic pessimism outweighs optimism

Two-in-five say they’re worse off than they were 12 months ago

2021 was a year of economic recovery for Canada, as economic output and employment returned to pre-pandemic levels. Despite the positive macroeconomic indicators, Canadians were hit with rising inflation, which peaked at 4.8 per cent in December, the highest it had been since 1991.

It is perhaps unsurprising then, that two-in-five (39%) Canadians say they are worse off now financially than last year. This represents the highest number of Canadians who feel this way in ARI’s polling dating back to 2010. More than two-in-five (44%) say their finances have held steady through 2021, but this represents the fewest Canadians who have said so dating back to 2010. Few (16%) feel like they are in a better financial position than last year:

There are significant regional differences. Pluralities in Alberta (49%), Saskatchewan (47%), Newfoundland and Labrador (47%), Manitoba (45%) and Nova Scotia (43%) feel their finances have taken a hit over the last year, while those in British Columbia are more split between the status quo (40%) and feeling their wallets pinched (38%). Still, one-in-five (21%) in B.C. feel like their financial situation has improved in the last 365 days – the highest number in the nation – while Quebecers (33%) are the least likely to feel they are in a worse position than one year ago:

And what about the year ahead?

Canadians’ outlook for the future is also more negative than positive. More (29%) believe they will be in a worse position financially in a year than believe they will be better off (23%). This represents an increase of eight points in the last year, climbing to the highest level in 13 years of ARI data. The fewest (38%) since 2010 believe they will be able to hold steady:

At least one-quarter in all provinces believe the next year will be worse for their bank accounts, but negativity is at its highest in Saskatchewan and Newfoundland, where two-in-five believe they will be worse off financially one year from now. Quebecers are the least pessimistic (23%), and as many (24%) believe things will get better for their finances in the next year:

Part Two: Economic Stress Index

In order to better understand Canadians’ financial stress, the Angus Reid Institute analyzed a number of core variables involving relative levels of concern over debt, housing costs and household food costs, as well as the aforementioned self-appraisal of the past 12 months and the year to come, to create the Economic Stress Index.

The ESI yields four groups: the Thriving (24% of Canadians), the Comfortable (24%), the Uncomfortable (25%) and the Struggling (27%).

While the sample was nearly evenly split between the categories, there are significant differences in demographics.

Regional story

The Struggling are not evenly distributed across the country. In Newfoundland and Labrador, where nearly half (45%) are classified as Struggling, many are without jobs. The province’s unemployment rate was nearly double the national average in December, and oil production fell last year despite a rebound in energy prices. TD forecasts the province to have the lowest GDP growth in the country next year.

Saskatchewan’s economy has been battered on two fronts: a decrease in oil and gas production during the pandemic despite rising prices and poor conditions in the agriculture sector which nearly halved crop production in 2021. Despite unemployment that is below the national average, employment is still below pre-pandemic levels. There, one-third (35%) fall under the Struggling category.

Across the border in Alberta, though the province has benefitted from rising oil prices, oil production has increasingly relied on less labour. And there, too, the agriculture industry suffered from poor growing conditions, namely a severe drought. One-third (33%) of Albertans are Struggling according to the ESI.

Meanwhile, Quebec has both the highest proportion of population (31%) of any province classified as Thriving and the lowest proportion (19%) who fall under the Struggling category:

Major urban centres

When it comes to residents of Canada’s biggest cities, those in Montreal are faring better than most. One-third (35%) are considered Thriving by the index, the highest of any urban centre. Conversely, in Halifax, three-in-ten (30%) fall under the Struggling category. In Winnipeg, three-in-five (57%) find themselves Struggling or Uncomfortable:

“Middle age” = elevated stress

One-third (34%) of those who are 35- to 54-years-old, including two-in-five (38%) of those aged 45- to 54-years-old (see detailed tables), fall under the Struggling category. Notably, this is also the age most likely to have children at home.

There are gender disparities, too. Three-in-five (58%) men aged 18- to 34-years old are in the top half of the index, while half (51%) of women that age are classified as Struggling or Uncomfortable:

Low income households face huge challenges

Two-in-five of those in households earning less than $25,000 annually are Struggling according to the index, while a higher proportion of those at higher income brackets are more likely to be Comfortable or Thriving:

The Struggling see little hope ahead

For those who are Struggling, most say the second year of the pandemic has made things worse for them financially. Four-in-five (80%) say their household finances are worse off than they were a year ago, while one-in-five (19%) say things are about the same (see detailed tables).

Further, few who are Struggling according to the index are optimistic the next year will improve their wealth. One-in-ten (8%) expect to be better off, while the majority (60%) expect their financial situation to worsen. At the other end of the Index, half (49%) of the Thriving expect to be in the same situation with their finances one year from now, while two-in-five (43%) expect it to improve:

Part Three: Personal economic challenges

Debt a major source of stress for one-quarter of Canadians

Debt is a major concern for a significant minority of Canadians. One-quarter (24%) say their household debt causes them major stress, while fewer (18%) say they aren’t worried about that aspect of their finances at the moment. For a plurality, two-in-five (42%), debt is still a source of some stress.

By the Economic Stress Index, a majority of the Thriving (54%) are unbothered by their level of household debt and three-in-ten (30%) report having no debt at all, the most of any index group. At the other end of the spectrum, three-in-five (62%) of the Struggling say their debt is a major worry:

Across the country, debt stress varies. Atlantic Canadians are the least likely to report having no debt. One-quarter (23%) of Quebecers say they don’t worry about their debt, while for one-third of those in Alberta, Saskatchewan and Newfoundland and Labrador, debt is a significant stressor (see detailed tables).

Debt worries are more common for lower income households than higher income ones. One-third (35%) of those in households earning less than $25,000 annually say their household debt is a major cause of stress, though one-in-five (21%) of that group report being debt free. While two-in-five (40%) of those in households earning $200,000 or more annually report feeling a minor amount of stress related to their debt, they are also the most likely to report not being concerned by the money they owe at three-in-ten (29%):

Those aged 35- to 54-years-old – one-third of whom are Struggling according to the Economic Stress Index, as noted above – are the least likely to say they are holding no debt and more likely to report significant stress about their financial obligations than any other demographic. Two-in-five of men (43%) and women (43%) aged 55-years-old and older report no debt or not being stressed about the debt they have, the most of any age-gender group:

Majority believe looming rate hike would have negative personal impact

After another month of significant inflation in December, the highest level seen since 1991, many now believe a rate hike from the Bank of Canada is imminent.

Respondents were asked what the impact of a two per cent rate hike – the increment anticipated by a recent report by Scotiabank – would be on their household. For few Canadians (6%) this would be a positive announcement and one-in-five (22%) feel a rate hike would have no effect on them. One-third (34%) believe higher interest rates would have a minor negative impact and one-quarter (25%) believe the impact would be majorly negative.

A majority (53%) of the Struggling believe a rate jump would be very bad news for their household and a further one-quarter (25%) anticipate it would have a minor negative impact. Fourteen per cent of the Thriving would welcome a two per cent increase in interest rates, the most of any index group, while a plurality (42%) don’t believe it would impact them at all:

While few (7%) in households earning $200,000 or more annually would welcome a rate hike, they are the most likely (30%) of any income bracket to feel as if it wouldn’t have any effect on them. A plurality (36%) say it would have a minor negative impact. That is also the case among every group of households earning $25,000 or more annually.

The lowest income brackets are much more likely to believe an increase in rates would not be in their best interest. Three-in-ten of those in households earning between $25,000 and $50,000 annually (28%) and less than $25,000 annually (29%) say the Bank of Canada boosting interest rates would have a major negative impact:

For now, majority find their housing costs manageable

The Bank of Canada held interest rates low in 2021, and while house prices climbed, mortgage rates remained historically low. Reflecting that reality, three-in-five (57%) Canadians find their mortgage or rent easy or manageable to pay. One-quarter (27%) find rent and mortgage tough to pay and one-in-ten (11%) find it very difficult.

In Quebec, two-thirds (66%) report their mortgage or rent is easy or manageable to pay, the most of any province in the country. Those in Newfoundland and Labrador are divided evenly between finding it easy or manageable and finding it more difficult – the only province where that’s the case:

The picture in Canada’s major cities is varied. While a majority in Vancouver (54%) find their rent or mortgage manageable, they are the least likely to find it easy (5%) of any major urban centre. Across the country in Montreal, one-in-five (20%) have no worries when it comes to their housing costs. Torontonians are the most likely to report finding the costs of their rent or mortgage tough or very difficult (46%):

For nearly all of the Thriving, the cost of their living situation is easy to handle or manageable (96%). At the other end of the ESI, three-in-five (59%) of the Struggling say it’s tough to pay their mortgage or rent and a further one-third (36%) call it very difficult:

Number struggling to feed their household increases significantly

Food prices have been a subject of considerable attention in recent months. Prices for meat and dairy have risen significantly in the midst of supply shortages, and the average cost to feed a family of four is anticipated to rise by five to seven per cent in 2022 according to some estimates.

This comes as three-in-five Canadians (57%) say it has been difficult to feed their household recently. This represents a substantial increase in the number of Canadians saying this in recent years, and as recently as October 2021:

This measure delineates dramatically across the four groups on the Economic Stress Index. For those who are Thriving, food costs are manageable, or an afterthought. For those who are Uncomfortable or Struggling, putting food on the table can be a substantial challenge:

Wages not keeping pace

With inflationary pressure hitting households hard over the past 12 months, employers are facing pressure to increase wages in order to retain staff. Thus far, few Canadians say that their earnings are keeping pace with the cost of living.

Across all four of the groups on the ESI a majority of Canadians say that increases in the cost of living are outpacing their own personal earnings. This is much more the case for those who are Struggling or Uncomfortable:

Underscoring the pressure Canadians are facing are the data based around household income level. This phenomenon spares no group, regardless of their income level, though those with less income face the most serious challenges, as their limited earnings are being stretched further:

Survey Methodology:

The Angus Reid Institute conducted an online survey from Jan. 7 – 12, 2022 among a representative randomized sample of 5,002 Canadian adults who are members of Angus Reid Forum. For comparison purposes only, a probability sample of this size would carry a margin of error of +/- 2.0 percentage points, 19 times out of 20. Discrepancies in or between totals are due to rounding. The survey was self-commissioned and paid for by ARI.

Note: Because its small population precludes drawing discrete samples over multiple waves, data on Prince Edward Island is not released.

For detailed results by age, gender, region, education, and other demographics, and by the Economic Stress Index, click here.

To read the full report, including detailed tables and methodology, click here.

To read the questionnaire in English and French, click here.

Image – Ivanoh Demers/Radio-Canada

MEDIA CONTACT:

Shachi Kurl, President: 604.908.1693 shachi.kurl@angusreid.org @shachikurl

Dave Korzinski, Research Director: 250.899.0821 dave.korzinski@angusreid.org